Loan EMI Calculator

Loan EMI (Monthly Payable)

Total Interest Payable

Loan Amount

Total Amount

What is EMI?

Equated Monthly Installment (EMI) is the monthly payable amount to the bank or any financial institution until your taken loan amount is fully paid off. It includes part of principal amount and some interest on loan to be repaid. Tenure means number of months in which loan has to be repaid to bank. Amount has to be paid every month. Interest component which is included in monthly EMI is slightly larger during the initial months than the principal amount and it will get reduce gradually with each payment. Monthly EMI is totally based on what Rate of Interest (ROI) you have been assigned on that loan amount. Monthly EMI will never change, the proportion of interest component and prncipal will change with time. Initially Bank or any financial institute charge more interest amount in monthly EMI.

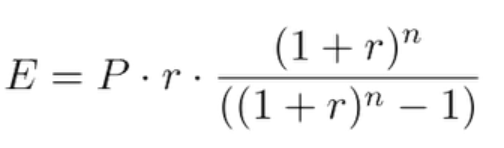

Formula to Calculate Monthly EMI

Where,

-

P is Principal Loan Amount

-

E is EMI

-

n is tenure / loan term / duration in number of months

-

r is ROI means rate of interest which calculated on monthly basis. (i.e. r = Rate of Annual interest/12/100. If rate of interest is 7.5% per annum, then r = 7.5/12/100=0.00675)

How to Use EMI Calculator?

Our Loan EMI Calculator is easy to use, You can also calculate Home Loan EMI, Car Loan EMI, Personal Loan EMI

You need to fill the following information in the EMI calculator

-

Your Principal Loan Amount

-

Loan Tenure (In months)

-

Rate of Interest

After filling all the details you can click on Calcuate button to calculate the monthly EMI based on provided information. Monthly EMI which are payable, Total Interest amount to be paid in your tenure and Total amount to be paid includes principal amount and Interest amount these 3 important details you will be able to calculate by using our Loan EMI Calculator.

Floating Rate EMI Calculator

Take two opposite scenarios to calculate floating / variable rate EMI, i.e. pessimistic (inflationary) and optimistic (deflationary) scenario. Loan tenure and loan amount, these two component are required to calculate EMI. Loan amount means how much loan you have borrowed from any bank or financial institutes and loan tenure means within how much months/years you are going to repay that loan amount. Rate of interest (ROI) is decided by the bank & HFCs which is based on there policies set by RBI and your credit score. As a borrower there are chances that you will be assign more or less rate of interest based your score, based on ROI monthly EMI is also change.

Optimistic (deflationary) Scenario

Let’s assume that Rate of Interest (ROI) come down by 1% – 3% from the current rate. Now, calculate your EMI based on this situation. Your EMI will come down or you may shorten you loan tenure periods.

Pessimistic (inflationary) Scenario

In the same way, assume that your Rate of Interest is increase by 1% – 3% from the current rate. This hike in ROI increase your monthly EMI way higher than previous EMI.

Advantages of using CoinFinanceMoney Calculator

-

CoinFinanceMoney EMI calculator is entirely free of charge and anyone from worldwide can used it at any time and as many time as they want

-

CoinFinanceMoney EMI calculator is 100% accurate.

-

It provide all the required details within few seconds.

FAQs

For what type of loan can I use CoinFinanceMoney Emi Calculator?

You can use CoinFinanceMoney EMI Calculator for all types of loans which includes Business Loan, Personal Loan, Home Loan, Car Loan. All you need to do is change Interest Rate, Loan Amount and Loan Tenure.

How does the debt-to-income ratio affect my chances of getting a loan?

To get loan, your debt-to-income ratio should be more than 50%. Otherwise, the lending institution will be led to believe that you may not have the means to repay the loan.

What are the components consider in Monthly EMI?

Monthly EMI consist of some part of principal amount and Interest amount. Initially Interest amount is higher than principal amount but gradually it will get reduce in monthly EMI amount.

What if I fail to pay the monthly EMI?

If you fail to pay monthly EMI then you be charges with late fees or penalty as per the bank or financial institute rules.

What components are mentioned in CoinFinanceMoney Result Set?

-

Loan EMI (Monthly Payable) : Calculated EMI amount which you are going to pay per month to bank or any financial institute.

-

Total Interest Payable : Total interest amount you are going to pay in complete loan tenure period. This amount is depends on your ROI.

-

Loan Amount : Loan amount you borrowed from any bank or financial institute.

-

Total Amount : Total amount consist of your Loan Amount + Total Interest Amount = Total Amount